To be a shareholder of LIC, farmers have to meet the following criteria:

- farm dairy cows in New Zealand;

- supply milk to a milk processor in New Zealand;

- have an LIC participant code; and

- buy Qualifying Products and Services from LIC of more than the Minimum Purchases Amount in any one year.

Qualifying Products and Services are provided for in the LIC Group Conditions and Service Rules.

The Share Standard is one share for every $6.25 of qualifying expenditure subject to the expenditure bands described below.

The Share Standard is based on a three year average annual qualifying expenditure rather than just the previous year's expenditure, and Shareholders will not be required to sell shares held in excess of the Share Standard.

Qualifying expenditure will be measured in uniform $5,000 bands (with the exception of the lowest band which is between $1,000 and $4,999.99), meaning shareholders will not need to adjust their shareholding until they pass through the upper end of the relevant band.

Each shareholder's Share Standard is the minimum entry point for each expenditure band. Each LIC shareholder must hold the prescribed number of ordinary shares which will be determined each year in accordance with LIC's Constitution.

This is known as your shareholding requirement.

Shareholders will be notified as soon as practicable after 15 July (in their annual shareholding statement from MUFG Corporate Markets) in any year how many ordinary shares they need to hold, and will have until 15 October in that year to ensure they hold the necessary number of ordinary shares to meet the share standard. This provides shareholders with a trading window to share up after notification.

LIC may automatically "share up" on behalf of shareholders in order for them to comply with the Share Standard, should shareholders fail to do so themselves.

See the LIC Group Conditions and Service Rules for information on becoming a shareholder in LIC and for information on qualifying products and services and minimum purchases amounts.

The Board of Directors will declare dividends, if any, in July each year.

Your entitlement to any dividend declared by the Board will be based on your shareholding on the first Friday in August. LIC will pay the dividend two weeks after that date.

You can get the dividend in one of three ways:

- paid in cash directly into your bank account;

- entered as a credit to your LIC account; or

- entered as a credit to your Dividend Reinvestment Plan so you can buy more shares, subject to the DRP being in operation at the time.

Any dividends paid on nil paid shares or any other shares held to meet the shareholding requirement, will first be used to pay off any outstanding liability on nil paid Shares.

Livestock Improvement Corporation (NZX:LIC) ordinary shares are listed on the NZX Main Board (NZSX).

The LIC share register is managed by MUFG Corporate Markets (MUFG).

Once you become a shareholder, MUFG will issue you with a FIN (Faster Identification Number) and a CSN (Common Shareholder Number) or Registration number.

You can view the current share price on the NZX site and get access to information about your LIC shares through the MUFG Corporate Markets website.

In July 2018, LIC simplified its share structure, bringing together its two classes of shares into a single class of shares (Ordinary Shares) which are listed on the NZX Main Board (NZSX) and are, therefore, subject to market pricing.

Shareholders approved the move to a single share structure at a special meeting in March 2018. Ministerial approval required under the Dairy Industry Restructuring Act, was received in April 2018.

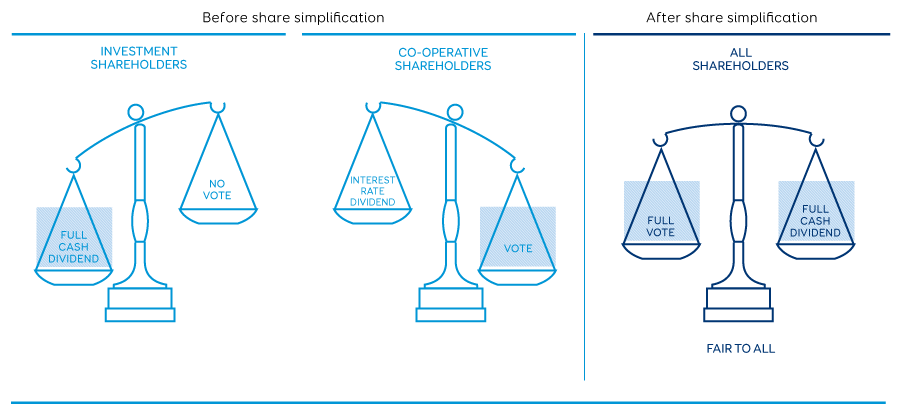

Prior to the share simplification, LIC had a dual share structure with two kinds of shares:

- Co-operative control shares - compulsory for qualifying farmers.

- Investment shares - could only be purchased by holders of co-operative control shares.

The Board proposed to simplify LIC's share structure by bringing the two classes of shares together into a single class to:

- Protect the co-operative principles that are fundamental to LIC

- Ensure a fairer system that treats all shareholders equally

- Give LIC capital flexibility to respond to inevitable future challenges and opportunities

- Support LIC's strategy (Vision, Purpose, Strategic Themes and Values)

- Deliver a simpler share structure with less hassle for shareholders and LIC

More information

More information

Email our Share Registry Team at [email protected] or call 0800 542 742 for more information about your LIC shares.